How to Open a Forex Trading Account: A Comprehensive Guide

Forex trading is one of the most popular and accessible forms of investment today. For those looking to start trading currencies, forex trading account opening Thai Trading Platforms offer various resources that can help new traders understand the market dynamics better. Opening a Forex trading account is the first step for anyone interested in this lucrative field. But, the process can be overwhelming for beginners. This article aims to simplify the steps involved in opening a Forex trading account, outline what you need to consider, and provide tips to enhance your trading experience.

Understanding Forex Trading

Forex, or foreign exchange, involves trading different currencies against one another. Traders make profits by capitalizing on the fluctuations in currency pairs. Unlike traditional stock markets, the Forex market operates 24 hours a day, five days a week, providing traders with the flexibility to trade at their convenience. Before delving into account opening, it’s crucial to familiarize yourself with how the Forex market operates, key terminology, and trading strategies.

Step 1: Choose the Right Broker

The first and arguably most important step in opening a Forex trading account is selecting a trustworthy broker. The broker acts as an intermediary between you and the Forex market. Here are some essential factors to consider:

- Regulation: Ensure the broker is regulated by a recognized financial authority, which provides a level of security and consumer protection.

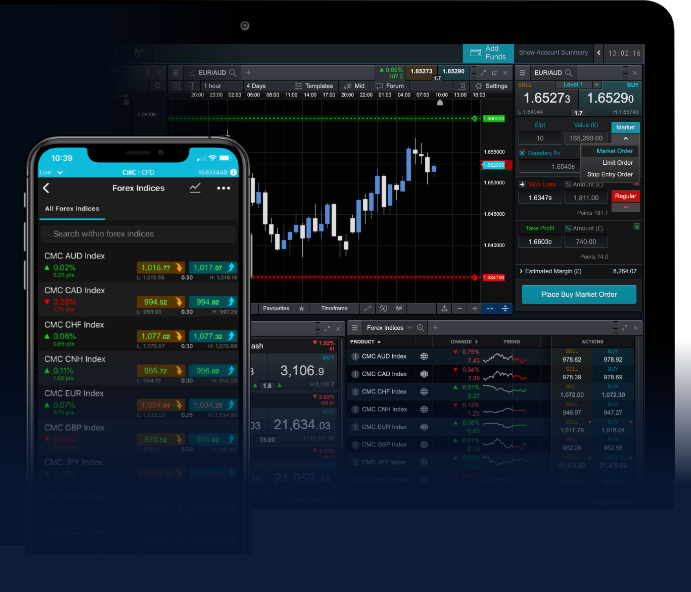

- Trading Platforms: Check the trading platforms offered by the broker. Platforms like MetaTrader 4 and 5 are popular for their user-friendly interfaces and advanced analytical tools.

- Account Types: Brokers typically offer multiple account types with varying spreads, leverage, and fees. Choose one that aligns with your trading strategy.

- Customer Support: A good broker should offer reliable customer support, including easy access to assistance when needed.

Step 2: Complete the Application Process

Once you’ve chosen a broker, you can begin the application process. This generally includes filling out an online application form. The information you’ll likely need to provide includes:

- Your personal details (name, address, and date of birth)

- Contact information (email and phone number)

- Income and employment status

- Trading experience and knowledge

Some brokers may also ask about your trading objectives and risk tolerance level. Be honest in your responses, as this will help the broker assess your suitability for their products.

Step 3: Verification of Identity

Most reputable brokers will require some form of identity verification to comply with anti-money laundering (AML) regulations. This usually involves submitting documentation such as:

- A government-issued ID (passport or driver’s license)

- Proof of residence (utility bill or bank statement)

The verification process may take anywhere from a few hours to several days, depending on the broker’s policies. Ensure that the documents are clear and legible to avoid delays.

Step 4: Deposit Funds

After your account is verified, the next step is funding it. Brokers generally offer multiple payment methods, including bank transfers, credit/debit cards, and e-wallets like PayPal or Skrill. Be mindful of the following:

- Minimum Deposit: Check the minimum deposit required to get started. This can vary by account type.

- Fees: Some payment methods may incur fees. Ensure you are aware of these before proceeding.

- Currency: Consider the currency you want to trade in, as this may affect conversion rates.

Step 5: Start Trading

Once your account is funded, you are ready to start trading. Most brokers offer demo accounts that allow you to practice trading with virtual money. This is an excellent way to familiarize yourself with the trading platform and test your strategies without financial risk.

When you feel comfortable, you can begin trading with real money. Here are some tips for effective trading:

- Start Small: Avoid risking large sums of money initially until you gain confidence and experience.

- Utilize Risk Management: Implement stop-loss orders to minimize potential losses.

- Stay Informed: Keep an eye on global economic news and events that may impact currency fluctuations.

Conclusion

Opening a Forex trading account can be a straightforward process if you take the time to research and choose the right broker. Understanding the market, knowing the options available, and utilizing proper risk management techniques are all crucial for a successful trading experience. With the right approach, trading in Forex can be an exciting opportunity to generate additional income.