Forex trading affiliate programs present an enticing opportunity for individuals looking to leverage their online presence for passive income. These programs are designed to reward partners for referring new traders to Forex and exchange platforms. By enrolling as an affiliate, you not only gain access to comprehensive marketing resources but also tap into a global market that spans across various demographics. To enhance your knowledge in the trading domain, explore forex trading affiliate programs Top Crypto Trading Platforms. This article delves into the various aspects of Forex trading affiliate programs, outlining their benefits, key features, and strategies for maximizing your earnings.

What are Forex Trading Affiliate Programs?

Forex trading affiliate programs connect brokers and affiliated marketers who promote trading platforms in exchange for commissions earned from trader activity. When affiliates successfully refer traders to a broker, they are compensated based on predefined agreement structures, commonly involving revenue sharing, pay-per-lead, or pay-per-click models. These programs allow individuals to generate income without needing to conduct trading themselves, offering a unique angle for those interested in finance and marketing.

Benefits of Joining Affiliate Programs

Joining a Forex trading affiliate program comes with several advantages:

- Passive Income Stream: Affiliates can earn commissions on a continuous basis as long as the referred traders remain active on the platform.

- Low Barriers to Entry: Most affiliate programs are free to join. Affiliates don’t need extensive technical knowledge or marketing experience to get started.

- Access to Resources: Many brokers offer ready-made marketing materials, tools, and support to help affiliates succeed in their promotional efforts.

- Global Market Reach: Forex trading operates 24/5, providing affiliates access to an expansive global audience, thus increasing referral potential.

Types of Commission Structures

Forex affiliate programs typically offer several commission structures. Understanding these can help affiliates choose the best plan for their marketing strategies:

- Revenue Sharing: Affiliates earn a percentage of the broker’s revenue generated from the traders they referred. This model can lead to substantial earnings if the referred traders are active.

- Cost Per Acquisition (CPA): Affiliates receive a fixed payment for each trader they successfully refer. This model provides more predictable earnings but may yield less over time compared to revenue sharing if the referred traders do not generate significant activity.

- Hybrid Models: Some programs combine both revenue sharing and CPA, allowing affiliates the flexibility to choose which model best suits their audience or marketing strategy.

How to Choose the Right Affiliate Program

When entering the world of Forex trading affiliate programs, here are key considerations to help you select the right program:

- Reputation of the Broker: Research the broker’s standing in the industry. Affiliates should work with reputable brokers that provide reliable services.

- Commission Structure: Evaluate the compensation model. Ensure it aligns with your promotional strategy and potential earnings.

- Support and Resources: Assess the marketing materials, training, and support provided by the broker. Comprehensive resources can significantly enhance your promotional efforts.

- Payment Methods: Check how and when payments are processed. Look for brokers that offer flexible withdrawal methods and timely payments.

Best Practices for Forex Affiliates

To maximize earnings from Forex trading affiliate programs, consider employing the following best practices:

- Understand Your Audience: Tailor content and promotions to meet the needs and interests of your audience. Different segments may require different approaches.

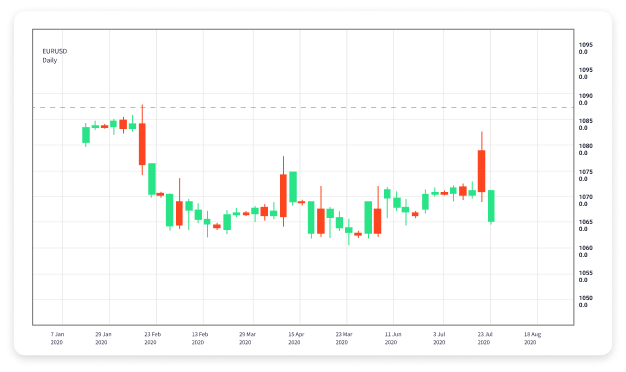

- Provide Educational Content: Offer insights on trading strategies, market analysis, tutorials, and tools to attract traders to your content and platform recommendations.

- Leverage SEO Techniques: Optimize your website or blog for search engines to drive organic traffic. Target competitive keywords in the finance niche to maximize visibility.

- Engage on Different Platforms: Utilize social media, email marketing, and online forums to reach a wider audience. Diversify your promotional channels to increase referral potential.

Challenges in Forex Affiliate Marketing

While Forex trading affiliate programs can be lucrative, they also come with challenges:

- High Competition: The Forex niche is highly competitive, with numerous affiliates vying for attention. Differentiation through quality content is crucial.

- Regulatory Changes: The Forex market is subject to regulatory scrutiny, which can affect brokers and, subsequently, affiliate earnings. Staying informed is critical.

- Time-Consuming Efforts: Building a successful affiliate business takes time and commitment. Prospective affiliates should have clear goals and timelines.

Conclusion

Forex trading affiliate programs provide an excellent opportunity for individuals eager to explore the financial markets without engaging in trading themselves. Through the right combination of marketing strategies, content creation, and a focus on reputation-bearing brokers, affiliates can create a sustainable income stream as a part of the global trading community. With the benefits such as passive income potential, access to diverse audiences, and flexible commission structures, the Forex affiliate marketing landscape promises ample opportunities for those willing to invest time and effort.

Start exploring Forex trading affiliate programs today and unlock the potential for financial success by leveraging your online presence and marketing skills!